Class and Mass Sizes

Download

Methodology

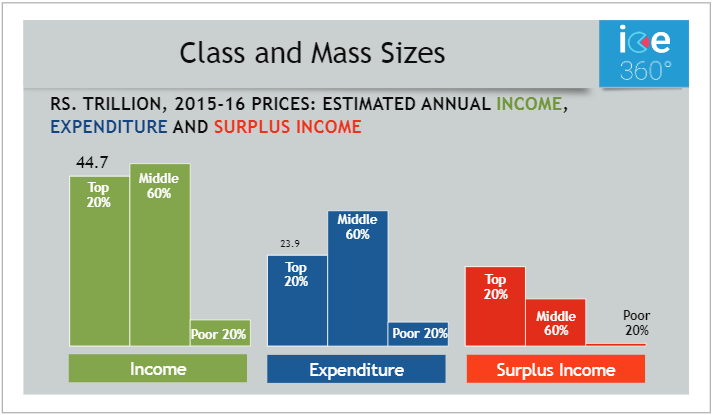

- The table on the left shows the combined income, expenditure and surplus income of the richest 20% of households (the so called middle class but we have called it the ‘class’ market) and of the ‘mass market’, the 60% households in the middle of the income ladder which we saw in the earlier table are very close together in income, and the poorest 20%.

Insights from this data include

- The larger size of the mass market pooled together than the class market on income and expenditure.

- The fact that surplus income is much greater with rich households. The bottom 40% of households are either dis-savers or live hand-to-mouth.

- It is only in the top 60% that we begin to see any surplus income details of which are given on the table to the right.

Copyrights @2021 | Designed & Developed by Rage Communications Pvt.Ltd.